How to Appeal your Property Taxes in Allegheny County

If you live in Allegheny County, have you noticed an increase in your property taxes since your purchased your home? In a recent court ruling at the end of 2022, Judge Alan Hertzberg ruled that new home buyers have been unfairly assessed after their home purchase. See for yourself in the articles and KDKA news video.

- Article 1 – Tax Relief for Allegheny Homeowners – Post Gazette – September 27, 2022

- Article 2 – Judge Blasts Pittsburgh Public Schools – Post Gazette – November 17, 2022

My broker, Berkshire Hathaway HomeServices The Preferred Realty has an affiliated business that will fight your tax appeals for you. All you have to do is visit www.alleghenycotaxappeal.com and fill out the form or call 412-548-1527. The fee for them to do this for you is 1/2 of the savings you will get in the first year. So if they can drop your property taxes by $1,000, their one time fee is $500. But you have until March 31 to do so!

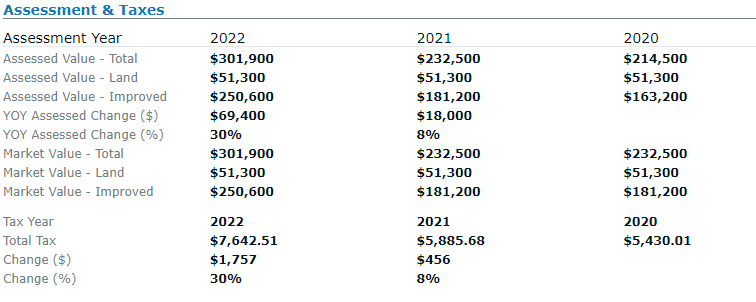

Let me explain how this works with a real life scenario of a client of mine who purchased a townhome in Village at Pine in 2022. Here is a breakdown of the taxes in 2021 verses when they purchased the property in 2022 for $385,000.

2021 Assessed Total Value = $232,500

2022 Assessed Total Value = $301,900 (an increase of $69,400)

2021 Total Taxes = $5,885.68

2022 New Taxes = $7,642.51 – Their taxes increased $1,756.83 or $146 a month! That can really throw off your budget from what you originally expected.

The court has ruled that the assessed value should be about 63% of the market value of the home or purchase price. So here is what my clients home should be assessed at moving forward:

$385,000 x 0.63 = $242,550. That is $59,350 less than what it assessed for after they purchased the home. Since they are in Pine Richland School District, we have to apply their millage rate of 19.5867.

$242,550 x 19.5867 / 1000 = $4,749.77. This should be their new School Tax amount.

Property taxes in Village at Pine are made up of 3 components: School Tax, County Tax and Township Tax. What is not shown above is a breakout of each so I’ll show you below.

$4,749.77 – School Tax (19.5867 millage rate)

$1,427.99 – Allegheny County Tax (4.73 millage rate)

$ 301.30 – Pine Township Tax (0.9980 millage rate)

$6,479.06 – Total new property tax

Under the new ruling, my clients should be paying $6,479.06 instead of $7,642.51. That is a savings of $1,163.45!!

Allegheny Tax Appeal will fight to get this decrease for you. All you have to do is contact them and you don’t have to show up at the courthouse or anything. Their fee in the case of my clients home would be $581.73 (savings of $1,163.45 / 2). It’s a one time fee and you enjoy the lower tax benefits for years to come!

This is the advantage to using me as your real estate agent! Only Berkshire Hathaway HomeServices The Preferred Realty offers this service, no other brokerage does. But then it’s up to me as an agent to alert you about this. That is the level of service you can expect from me. Even after you have bought your home with me as your agent, I am still providing value to you in the years after your purchase.