With all the excitement the end of the year brings celebrating Halloween, Thanksgiving and Christmas, I have to pull my head out of my kid’s candy bags and wake up from the turkey hangover and remember tax season is also on it’s way. Around this time of year I start putting together my tax spreadsheet that will be handed off to my accountant to prepare my taxes.

Part of this preparation is looking at all the ALTA’s I have from buying and selling properties throughout the year. If you’ve read my About Me page, you’ll see that I am a Realtor, real estate investor and house flipper.

If you bought or sold a home this year, you also have an ALTA that will be needed for tax preparation. An ALTA is the form you signed at closing with all the details and numbers behind the purchase or sale of your home.

If you sold a home this year then listen up! I am about to get you some spending money for the holidays 🙂 .

For municipal utilities such as water bills, the closing company typically requests a final bill on your behalf. The final bill is paid from the proceeds of the sale so there is no outstanding money owed.

These are lienable charges, meaning the municipality can file a lien against your home if say you don’t pay your water bill. The closing company does not want to leave the new owner a lien on their home because you the seller did not pay your bills.

So the closing company typically escrows anywhere from $100 – $500 for final water bills. This means they are keeping this money from you in case something comes up after the sale.

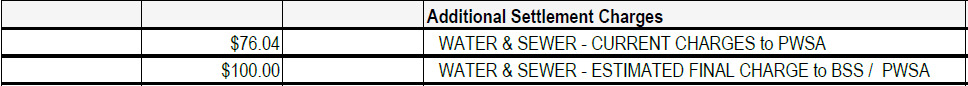

Here is an example of what the escrow looks like on the ALTA from one of my own properties that sold in July:

As you can see, the $76.04 was the current amount owed to PWSA (Pittsburgh Water & Sewer Authority) on closing day. The $100 is extra money the closing company withheld from me in case there is more money owed for some reason.

Once the dust settles, usually a month after closing, the closing company is supposed to send you a check for the unused portion of the money they kept from you.

However, they often times are not keeping track, which is what happened in my case!

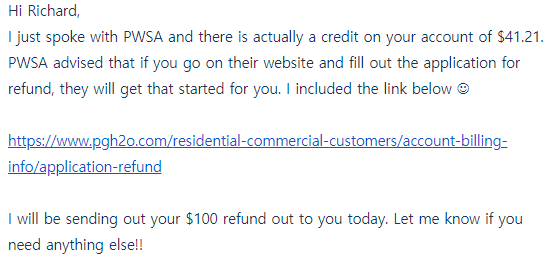

I didn’t catch this until October, which was 3 months after the property sold. So I emailed the closing company and found out that I was owed $41.21 from PWSA and the closing company would refund the extra $100 they withheld!

As you can see, PWSA or the closing company was not concerned that they owed me money they held in escrow. Which makes me wonder how many people out there are owed money and don’t even know it and may never collect it.

For PWSA, it was easy to request a refund. They have an online form to fill out and you don’t have to print – scan – email it back or snail mail it back. The downside is it could take 4-6 weeks to process a refund. Make sure you have it sent to your new address!

Thankfully I should have the money refunded before the end of the year so I can account for this appropriately in my taxes (applies to investment properties, won’t matter if it was for your personal residence).

Did you sell a property this year? Feel free to leave a comment below and share if you were owed money long after you sold your home. Or maybe the closing company was proactive and kept track of this for you and sent you a refund automatically. Either way, it would be nice to hear what others have experienced!